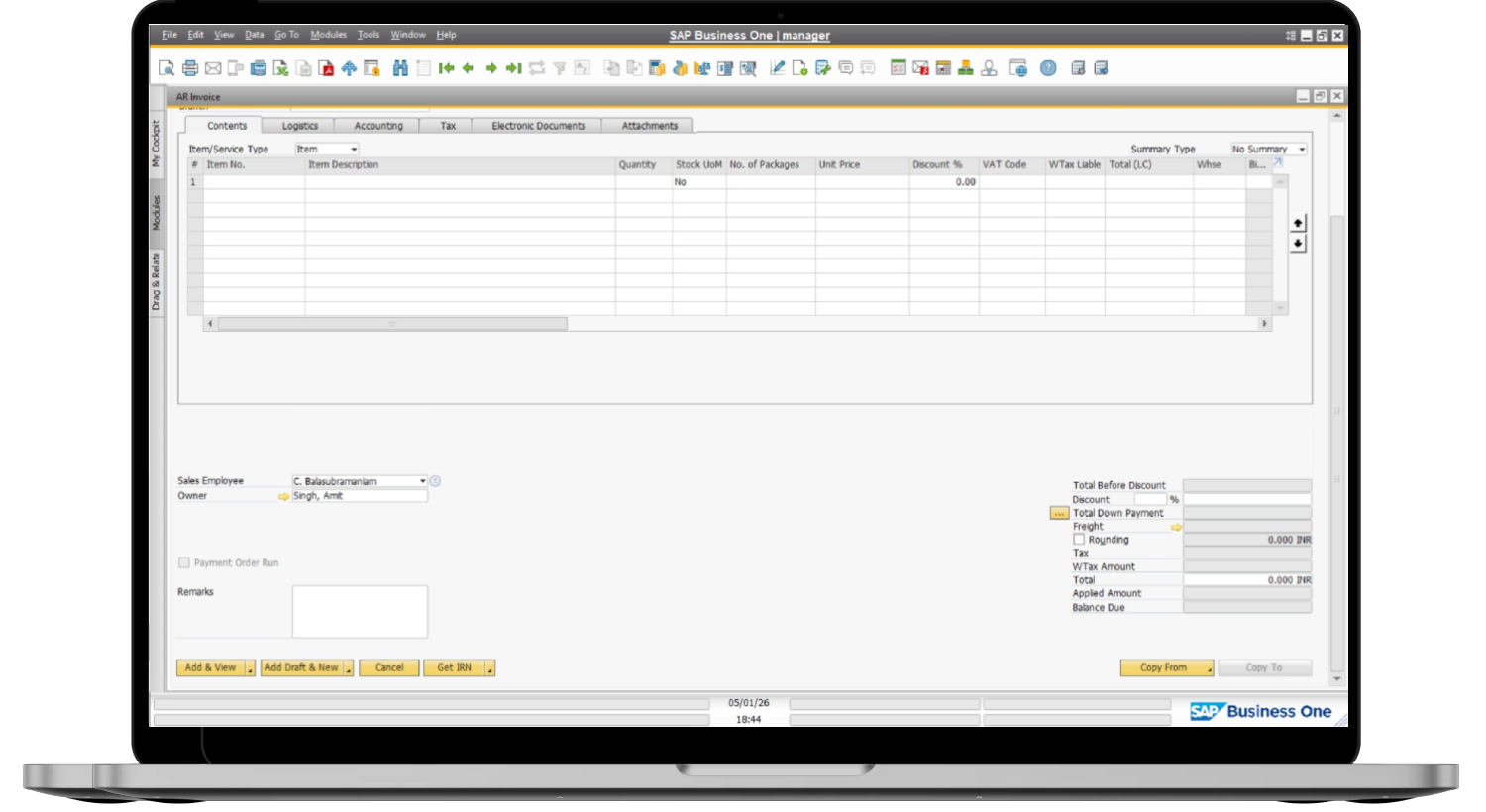

Generate E-invoices & E-way Bills in a Single and Simple Click with GST One.

With GST One seamlessly integrated with your trusted SAP Business One ERP solution, generate GST E-invoices in the standardized format effortlessly. Start your e-invoicing journey with confidence, ensure full compliance, and keep your operations running without disruption.

Trusted by some of the fastest growing companies:

BenefitsCompiant And Accurate GST e-Invoicing

With GST One automating e-invoicing, e-way bill generation, and reconciliation, businesses experience up to a 90% reduction in manual tax errors and mismatches.

Companies using GST One report up to 50% faster GST document generation and filing turnaround thanks to one-click IRN/e-way bill creation within SAP Business One.

Integrated GST validation and portal connectivity deliver up to 98% accuracy in tax reporting and reconciliation, improving compliance confidence.

Connect with our GST One Experts!

Simplify GST billing, e-invoicing, and compliance with GST One, the exclusive add-on for SAP Business One. Eliminate manual errors and generate GST-compliant invoices with speed and confidence from within SAP B1.

Frequently Asked Questions

GST One is an add-on for SAP Business One designed to simplify and automate Goods and Services Tax (GST) compliance for businesses operating in India. It integrates seamlessly with SAP Business One, helping businesses manage GST-related processes, including tax calculation, invoicing, return filing, and reporting.

GST One is ideal for businesses using SAP Business One in India that need to comply with GST regulations. It’s particularly useful for companies looking to streamline their tax processes, reduce manual errors, and ensure timely and accurate GST compliance.

GST One’s key features include but are not limited to:

- Automated GST Calculation: Automatically calculates GST for transactions based on the latest tax rates and rules.

- Invoice Generation: Generates GST-compliant invoices and credit/debit notes.

- GST Return Filing: Prepares and files GST returns (GSTR-1, GSTR-2, GSTR-3B, etc.) directly from SAP Business One.

- Reconciliation: Automates reconciliation of GSTR-2A with purchase data, ensuring accuracy in return filings.

- Reporting: Provides detailed GST reports and analytics to help manage compliance effectively.

GST One is regularly updated to reflect the latest GST rules and regulations. This ensures that your business stays compliant with current laws without the need for manual updates.

Yes, GST One can manage GST compliance across multiple locations, branches, or business units, ensuring that each location’s tax requirements are accurately managed and reported.

GST One automates the preparation and filing of various GST returns, such as GSTR-1, GSTR-3B, and GSTR-9, directly from within SAP Business One. It reduces manual data entry, minimizes errors, and ensures timely submission of returns.

GST One ensures that all invoices generated are GST-compliant, including the correct tax rates and other necessary details. It also supports the generation of e-invoices and the automatic calculation of taxes.

Yes, GST One includes features for generating e-Way Bills as required by GST regulations. It simplifies the process of tracking and managing e-Way Bills within SAP Business One.

GST One provides tools to reconcile GSTR data with your purchase records, helping to identify discrepancies and ensuring accurate input tax credit (ITC) claims.

Yes, GST One is equipped to manage both B2B (Business-to-Business) and B2C (Business-to-Consumer) transactions, ensuring that GST is calculated and reported correctly for each type of transaction.

Yes, Accelon Technologies offers training sessions to help your team understand and effectively use the GST One Add-On. This includes on-site training, online tutorials, and documentation.